Spot V.S. Forward Volatility

A common approach in many pricers is to model volatility on the forward price. While this method is easy to implement, it introduces significant and often overlooked inconsistencies.

Why Modeling Volatility on Forward Is Inherently Inconsistent

In a forward-volatility framework, the underlying behaves like a forward contract: the “price” being modeled embeds spot, interest rates, borrow costs, and dividends. Volatility is then applied to this forward price rather than the traded spot price. Because the forward price itself is expiration-dependent, this creates inconsistencies across option expirations.

Consider a basic question: when pricing an option that expires before an ex-dividend date, should the future dividend be included in the pricing inputs? If it is included, then a dividend paid after expiry incorrectly influences the option’s present value. If it is not included, then options expiring before and after the dividend are priced on different asset price bases, and their implied volatilities become non-comparable.

Economically, an option expiring just before a dividend and another expiring just after — with strikes differing exactly by the dividend amount — should have nearly identical values. Under the forward-volatility approach, they do not. The shorter-dated option is priced higher simply because its forward price is higher, resulting in the same volatility being applied to two different effective price levels. Moreover, realized volatility in practice is almost always computed from spot returns, not forward returns.

A Hypothetical Example

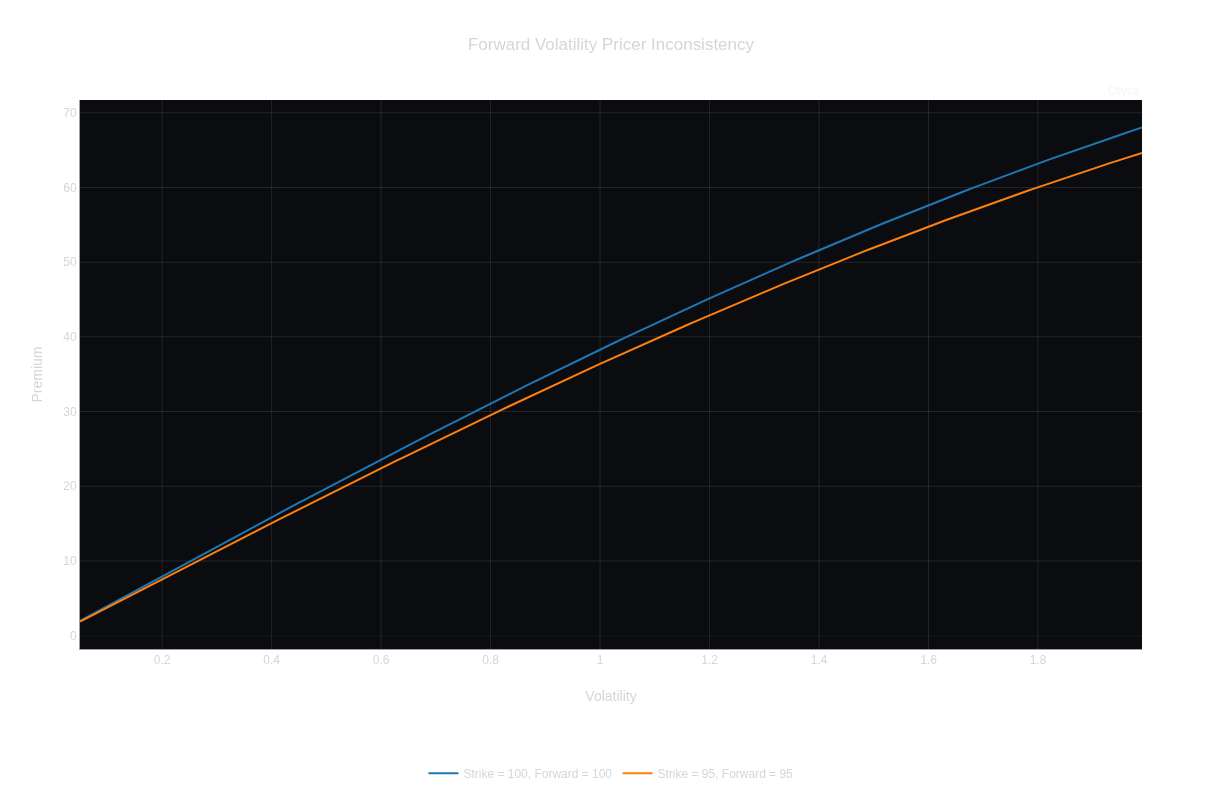

Consider two European calls on an underlying with a spot price of $100 and a known $5 dividend exactly one year away. One call expires immediately before the dividend with a strike of $100; the other expires immediately after the dividend with a reduced strike of $95. Economically, these two calls should have the same value given the same volatility. In a forward-volatility pricer, they do not — the shorter-dated option is priced higher, and the discrepancy grows with increasing volatility.

How Much Does It Really Matter?

Our pricer eliminates these inconsistencies by modeling spot-price returns directly, ensuring volatility is applied to the price the market actually trades. This produces consistent valuations across expirations, preserves continuity around dividend dates, and aligns with how realized volatility is measured in practice. See the difference using our option calculator here.