Settlement & Trading Calendar

American and European options are highly sensitive to settlement mechanics. In the U.S., stocks, ETFs, and their options now follow a T+1 settlement schedule, effective May 28, 2024. This means that a trade executed on Monday settles on Tuesday (excluding holidays). On expiration day—usually a Friday—exercised options typically settle the following Monday.

Why This Matters

Ignoring settlement lags can lead to miscalculated delta hedging and carry costs. An option’s premium reflects the expected cost of dynamic hedging, so failing to account for the full hedging horizon can produce significant pricing errors. With T+1 settlement, the actual hedging period may extend several days beyond naive assumptions, making accurate modeling critical for pricing.

Suppose on Monday we price a call option expiring that Friday. The dynamic hedge is executed Monday but settled on Tuesday. On expiration, exercised options are settled and the hedge is rewound, with settlement occurring the following Monday. A pricer assuming same-day settlement would treat the hedging financing period as Monday to Friday. In reality, the true financing span runs from Tuesday to the next Monday — two extra days.

A Real-World Example

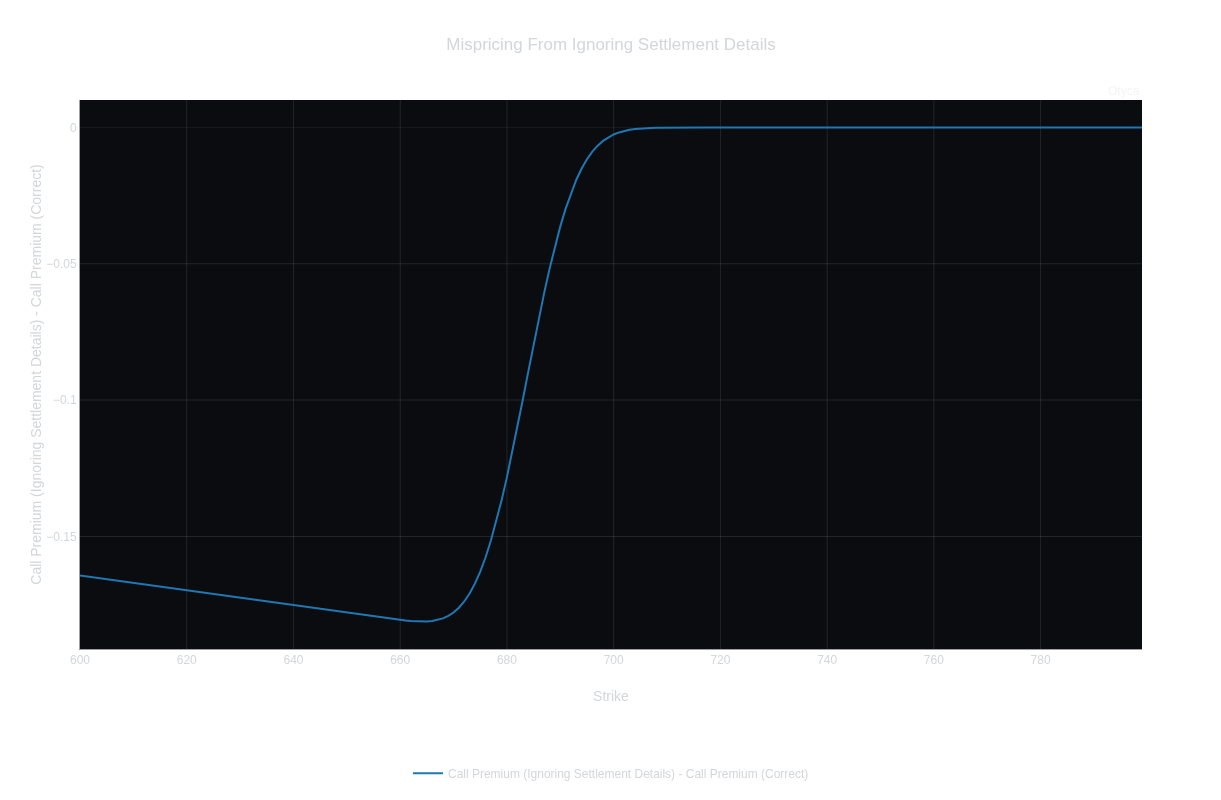

The figure below illustrates the impact of ignoring settlement rules on option pricing. On November 12, 2025, a few SPY call options expiring November 14, 2025 were priced. A pricer that does not account for settlement lags mispriced certain strikes by up to $0.1, whereas the typical bid–ask spread for these options is only about $0.02. This means the misprice was as large as 5× the market spread.

How Much Does It Really Matter?

Our American option pricer explicitly accounts for:

- T+N settlement of underlying and option trades

- Weekends, holidays, and half-trading days

Experience the difference directly with our option calculator here.